Fresno State’s Money Management Center collaborated with Associated Students, Incorporated (ASI) and tax company H&R Block to bring Love and Taxes, an event designed to educate and prepare qualifying students’ federal tax refunds for free on Feb. 14.

“We’ve been noticing we’ve been getting a lot of questions about taxes,” said Charah Coleman, coordinator of the Fresno State Money Management Center. “We hosted it, while H&R Block and ASI contributed to making sure that the taxes were free for students.”

The Money Management Center, which is located in the Thomas Administration Building, helps students manage their finances year-round. For that reason, it was important for the center to educate students about taxes with the help of H&R Block.

“H&R Block [representatives] are not only here to answer students’ questions about taxes, but also to do students’ federal tax returns for free, too,” said Coleman. “If you want to do your taxes, and maybe this is the first time doing them yourself, you can ask them questions and get help.”

Coleman and her money managing team have done tax workshops in the past and plan to do more in the future.

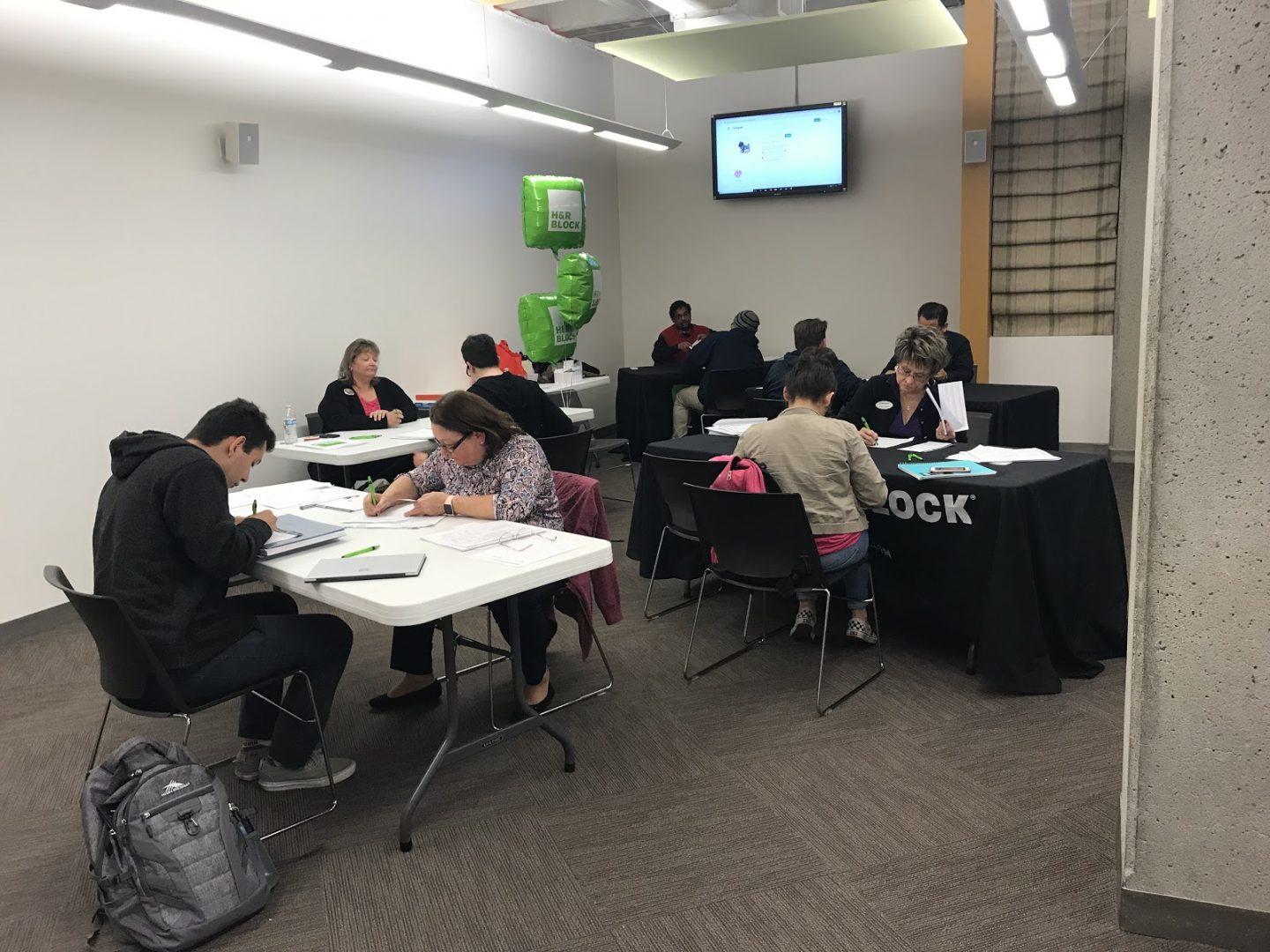

This year, the tax workshop took place on two days: Feb. 12 and 14, during the week of Valentine’s Day, hence the name Love and Taxes. And in an event where pizza is provided for free as well as the chance to win prizes, there was plenty of incentive for students to attend. Indeed, it was no surprise that the Henry Madden Library room 2206 was filled with students.

While the free pizza and the raffle prizes””which were donated by H&R Block and

ASI, respectively”—made it fun” for students while they waited, and helped them “pass the time” as Coleman described, the main objective of the event always stayed prominent: this was to help students with their taxes.

“Most people who come here are young and don’t know what to do, what the process is when doing taxes,” said Sergio, a student assistant of the Money Management Center. “It’s nice that they have agents here who can talk them through it and explain the whole process. “

“It’s safer to do it here,” he continued.

Although Love and Taxes was a free event, students could only get their taxes done if they qualified.

The first 200 students could get their taxes done for no cost if they met the requirements of: (1) having an income under $15,000, (2) possessing a student, federal or state ID, (3) bringing a W-2 form, and (4) having a W-2 income only. If students didn’t meet the qualifications, they would be “deducted from their refund,” as student, Jennifer Bonilla was.

“If you make over a certain amount, you have to pay,” said Bonilla, who learned about the workshop through of a flyer and an email. “I thought it was going to be free.”

Love and Taxes will be back next year. Coleman said she hopes it will be a longer event.

“Next year, we will probably have it on three different days, with different times to help people with different schedules,” Coleman said.