Republicans in the Senate last week voted yes to overhaul the country’s tax code. With the House already having approved its version, Congress is set to compromise on a tax reform bill that could be sent to the president for his signature.

On the heels of a hasty vote last Friday, the Joint Committee on Taxation and the Congressional Budget Office said that the Senate-proposed bill would add $1 trillion to the national deficit over a 10-year period. GOP legislators continue to promise otherwise.

But as the Senate and House bills are joined to make one, there are provisions in the House version that could stress graduate students. The tax bill from the Senate does not include any measures on higher education.

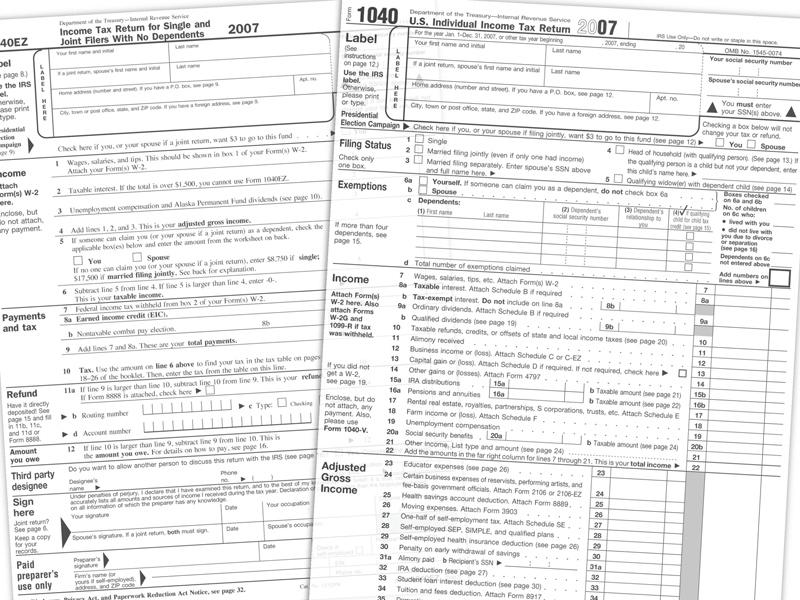

The tax bill introduced by the House would repeal the Lifetime Learning credit, which provides a tax credit of up to $2,000 per taxpayer for education expenses, and it would end the ability for graduate students to deduct tuition and fees and student-loan interest from their taxes, leaving them to pay more for their education.

Dr. James E. Marshall, dean of research and graduate studies at Fresno State, said that while the House bill might not affect too many graduates at Fresno State, there would still be some burdens added to graduate students studying at the university.

Out of 2,231 graduate students at Fresno State this fall, 1,968 are working toward a master’s degree, while 251 are pursuing their doctoral degree. Twelve graduate students are pursuing a certificate in advanced studies, Marshall said.

Graduate students at Fresno State are not offered stipends like those given at other universities. Marshall said some eligible graduate students pursuing their master’s degree get “partial fee waivers” that are called “sponsorships” if they become teaching assistants.

The House tax bill would force that tuition reduction to become taxable, Marshall said. For a few non-resident graduate students who get tuition waivers, their waived tuition will also become taxable if the House bill’s provision remains in a final bill.

Marshall said that taxing non-resident tuition waivers for graduates from out of state could deter them from coming to Fresno State. Further, he said that taxing previously waived tuition also has the potential to impact graduate research productivity if fewer students decide to enroll in a graduate studies program.

Although “nothing is set in stone yet,” Marshall said about the House tax bill provision, “it has the potential to negatively affect some graduate students.”

Democrats unanimously opposed any tax bill offered by the Republicans. Only one GOP Senator voted against the Senate’s version due to the $1 trillion deficit impact. Now, the GOP will take its bills and turn them into one. They expect to send a tax reform bill to the president before Christmas, according to reports.

For Marshall, he hopes any final tax bill is one that does not hurt students’ higher education.

The Council of Graduate Schools, which includes Fresno State as an affiliate, released a statement encouraging legislators to consider maintaining the current tax provisions that help graduate students finance their education.

It stated that since graduate students already pay high interest rates on their loans, a tax bill that targets education by removing the ability of the graduate students to deduct the loan interest payments “only increases their debt.”